When traveling abroad, of course, it is very exciting with family, partners, even on business trips, even though traveling abroad is still a very pleasant thing, it’s just that sometimes we often forget to take into account the expenses needed.

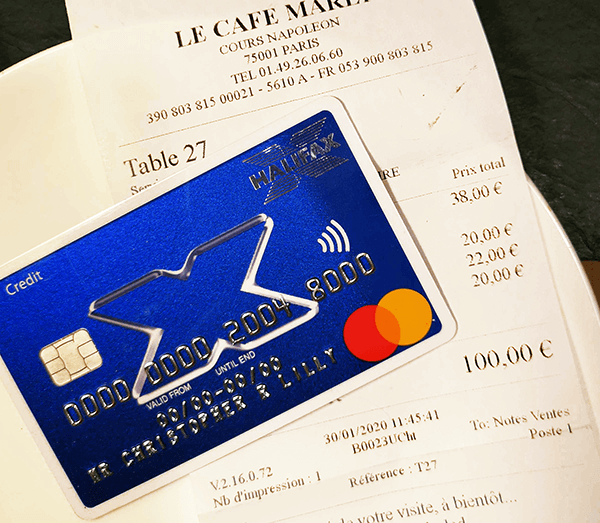

This time I will explain a little about credit card by Halifax Clarity which “we think” is highly recommended to help save your money when traveling abroad for holidays, work or other things, apart from that this credit card by Halifax Clarity can also provide the user with protection Additionally, see the review below.

Several years ago, with the many confusions that have occurred, we have seen a little uncertainty in every travel agency. Whether it’s airplane or ship travel, in several news references it is reported that the traveling costs to Europe is very expensive, indeed, with the pandemic, many things are true. We really can’t guess beforehand.

That is why it is very important for us to arrange travel costs, apart from that the pandemic has also taught us the importance of self-protection when traveling, such as insurance and other things that must always be prepared. So, can a card credit really work? help? and card credit by Halifax Clarity really worth it?

The advantages of the credit card

According to several sources, this card credit by Halifax Clarity is highly recommended. As is the case with credit cards in general, even though this credit card is labeled as a travel card, it is still the same “credit card”, so you don’t need to worry, you can still withdraw funds from the card.

This, not only that, you can also make purchases from online shops or other retail outlets with a card credit by Halifax Clarity and if you know the biggest advantage of this credit card is that there are no fees that you use even when you use it abroad, interesting right? The card credit by Halifax Clarity seems designed for travelers who like to travel the world.

Another fact is that the card credit by Halifax Clarity is almost perfect. apart from there are no fees when shopping even if it is sold in the country, exchange money at official exchange, you will not be subject to any deductions, this is really very interesting, not enough, there’s more when you Use a card credit by Halifax Clarity for purchases, you will be offered up to 56 days free.

This means” make you can take a vacation, come home and have time to pay off before your balance you are charged interest. But it is important, note that if you use the card to withdraw money, will be charged interest from moment you withdraw a money.

And if you are accepted the advertised rate of 19.9 per cent, withdrawing £100 in local currency will cost you around £1.66 if payment takes a month. And remember you are eligible take a claim under Section 75 protection. Buy anything over £100 and there is a problem, the credit card company and the seller are responsible.

This means you can take a claim with your card instead to go back to merchant. Plus, card credit by Halifax Clarity is also a Mastercard brand so you can easily use it almost anywhere in the world and it’s guaranteed to be accepted at more retailers than American Express, both domestically and internationally. card credit by Halifax Clarity,

Disadvantages of the card credit by Halifax Clarity

Don’t Forget, if you looking for a product like this card credit by Halifax Clarity, there are competing products that also offer cash back on all your purchases. This is a basic credit card. There are no points or miles associated with this card credit by Halifax Clarity, so you won’t get anything rewarded purchases that you make with this card credit by Halifax Clarity.

The big selling point of this card is that there are no cross-border transaction fees if you use it for cross-border purchases, both domestic and international, while many gift-generating credit cards charge up to 3% for purchases overseas.

Halifax also charges no fees for using the card credit by Halifax Clarity to withdraw cash from domestic or international ATMs, which can be a money saver when traveling. Note, however, that while purchases are interest-free for up to 56 day in each billing cycle, interest accrues immediately on deposits.

ATM/ATM issuers (particularly overseas) may also charge you a withdrawal fee, which Halifax passes on to the cardholder, although Halifax does not charge ATM fees itself. Overall this credit card is nearly perfect but the lack of a rewards program makes the product less than perfect but overall this card is very good.

Card Credit by Halifax Conclusion

For credit card with no international fees, this product competes with the Barclaycard Rewards credit card which is arguably a better product because there no annual fee and no international fees transaction. The Barclaycard Rewards credit card also offers cash back, both in the form of a £25 welcome bonus and ongoing 0.25% interest on all domestic and international purchases.

In addition, Virgin Money recently announced that they will no longer be charging foreign fees transaction. for any international purchases, even if it’s a rewards credit card. According to several sources, this card is intended to be marketed to people who make purchases in foreign currency domestically and abroad regularly but still want access to credit products.

The use of credit score credibility also applies so if you have good record, right? there ‘s no way there will be more feedback than the card credit by Halifax Clarity again, overall this credit card is very good and I think if you are someone who likes to travel try to cover everything you need with this card credit by Halifax Clarity.

But of every advantage it is always followed by disadvantages nothing will be perfect, security, convenience, as well as other benefits are clearly stated on this credit card, all you have to choose, is this credit card right for you?

*You will remain on the current site